Investing in U.S. stocks can be daunting to most Kenyans. The high barriers to entry such as high minimum investment amounts and lack of enough information available to the general public haven’t made it easier. You don’t know where to start and who to trust with your money. This is where Ndovu comes in. Ndovu is a leading savings and investment platform whose mission is to make investing accessible to all Kenyans. Ndovu currently has over 100,000 customers who it has acquired through strategic marketing, paid media, organic content, and referral programs. The company says it is still keen on ensuring a good customer experience and drive financial inclusion across Kenya and Africa at large.

By making investing in U.S. stocks accessible to Kenyans, Ndovu makes it easier for individuals looking to grow their investments locally or tap into global markets. It does all this by offering seamless, affordable investment opportunities.

Why You Should Consider Investing Wealth Growth

Investing is one of the avenues you can take if you want to build wealth. Wealth building is crucial to ensure financial security, long-term stability and takes you closer to achieving your life goals. Having the right investments can help you grow your income, cushion you against inflation and in some cases, assist in securing a comfortable retirement.

Investment can provide:

- Higher Returns: Investments in stocks and money market funds can generate higher returns over time compared to traditional savings.

- Beating Inflation: Kenya’s inflation rate averages 6-8%, which can dilute your savings. Investments on the other hand help maintain and grow real purchasing power.

- Wealth Accumulation: Over time, compound interest and reinvestments help your investments grow exponentially compared to savings.

Investments can also generate passive income and thus reduce reliance on a single income source. With the right investment, you can ensure financial freedom and eventually a better life.

Investing is also much better than traditional savings accounts as savings often have lower returns that fail to keep up with inflation. Investment options like stocks and money market funds on the other hand provide higher long-term returns. For example:

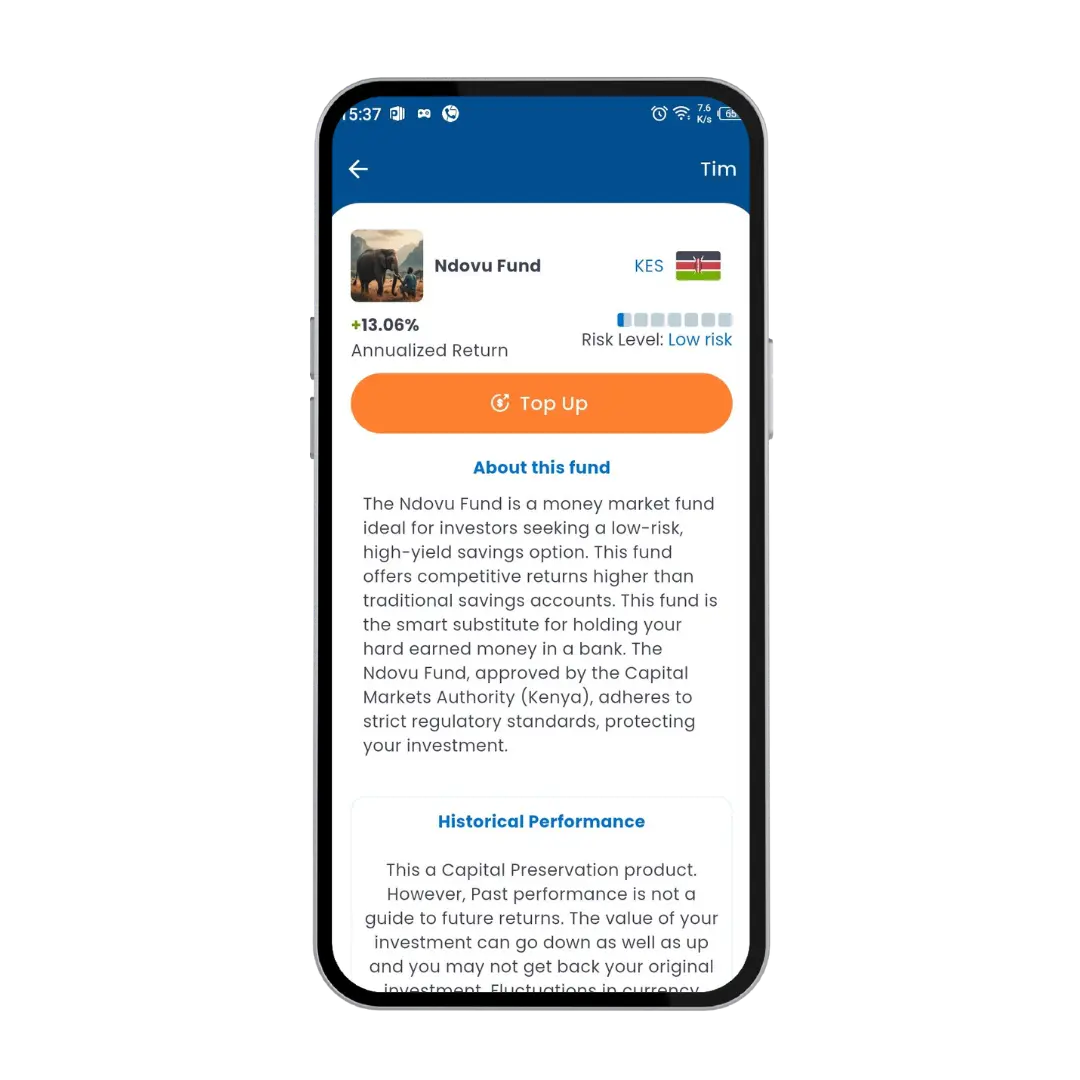

- Ndovu Fund offers a 13.06% annual return as of December 31, 2024. This is much higher than most savings accounts in Kenya and can cushion your savings against inflation.

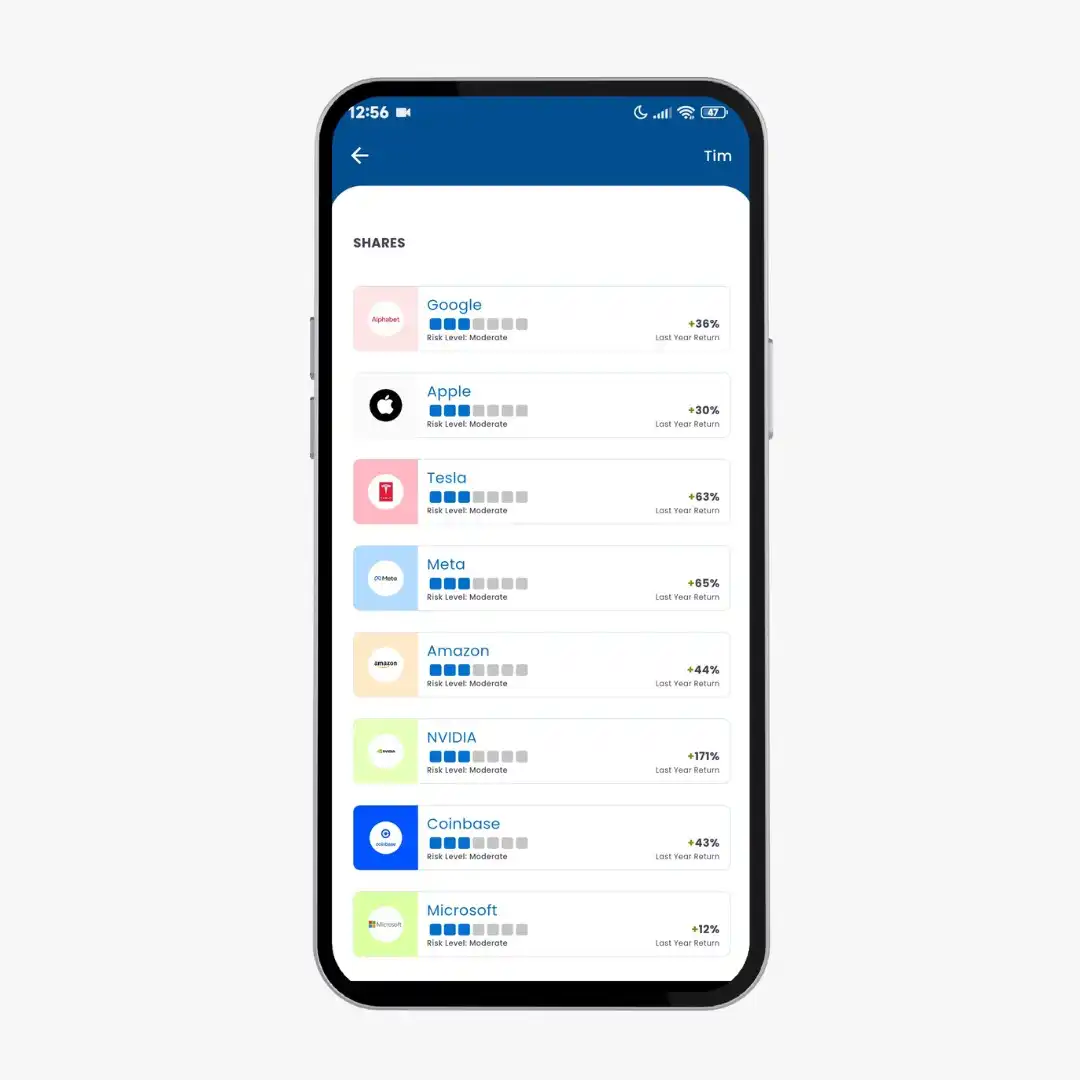

- Investing in U.S. stocks gives Kenyans access to high-growth companies such as Apple, Tesla and Google. These companies have historically provided 10%+ average annual returns over the long term.

How Ndovu is Changing the Investment Landscape

Lowering Barriers of Entry to Global Investing

Ndovu is currently running a campaign allowing Kenyans to invest in shares of U.S based companies with just KES 1,000. This is down from the previous minimum amount of Ksh 7,500 (about $50). This is a game changer for local investors who may want to try their luck investing in U.S. stocks. This campaign comes at the right time with the current economic times forcing people to cut their spending. With just Ksh 1,000, you can get your head in the game and grow your portfolio.

Secure and User-Friendly Platform

Ndovu ensures safety and security as they use licensed custodians and this ensures your investments are secure. This should give you the peace of mind that your investment is secure at all times. The platform is also easy to use making it easy to start investing even for beginners.

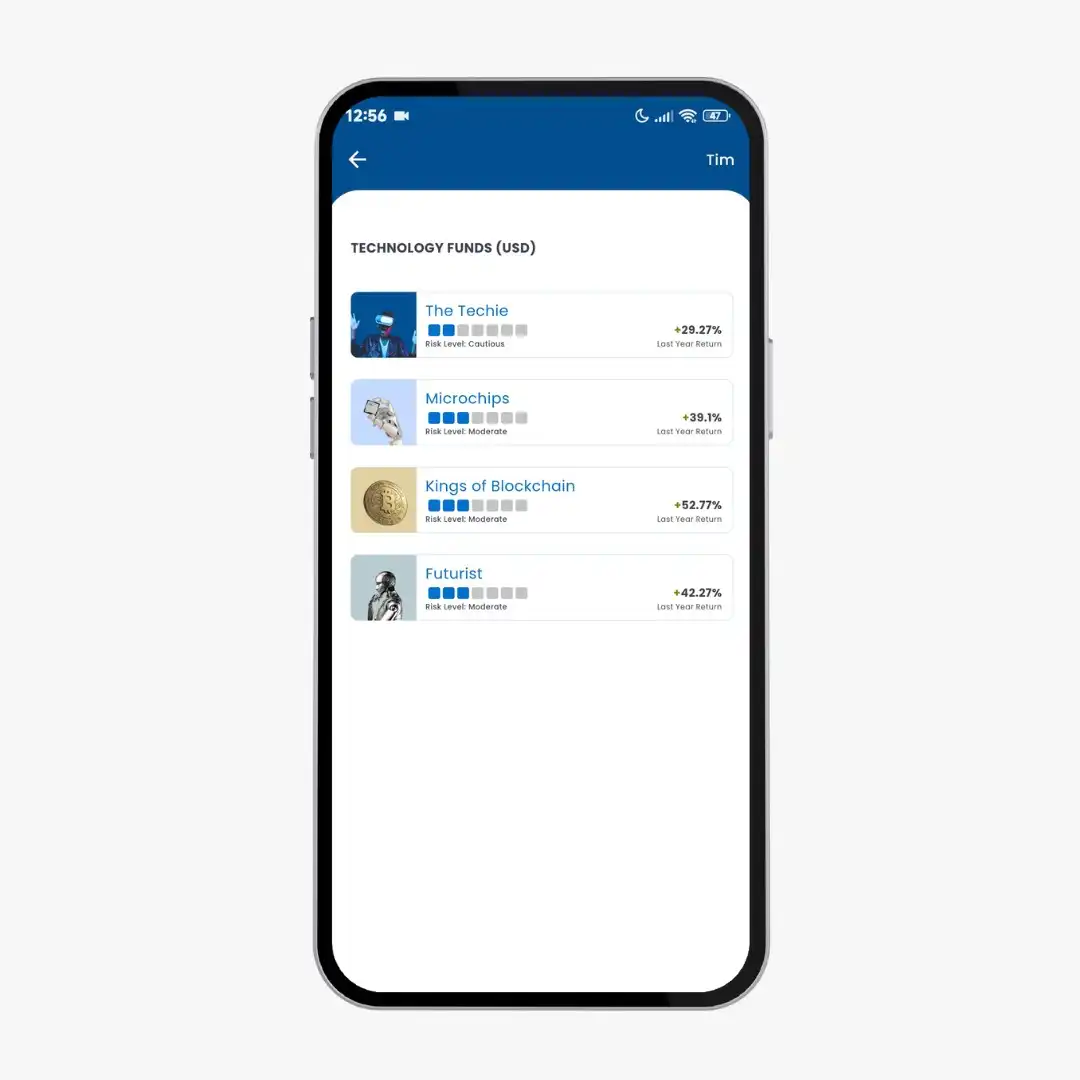

Diverse Investment Opportunities

Ndovu does not limit your investment options. You can decide to invest in both local money market funds and global stocks. With the current campaign allowing as low as Ksh 1,000, you can start your investment journey with U.S. stocks.

You can also decide to invest in the Ndovu Fund which offers annual returns of up to 13.06% as of Dec 2024 which is an inflation beating return. This is one of the highest returns you can get in the country currently. Putting your money into this MMF allows it to grow passively.

How to Get Started with Ndovu

With all that said, you may be wondering, how can I get started with Ndovu and start your investment journey. Below are the steps to follow to get started:

- Download the Ndovu app from the App Store or Google Play.

- Sign up on Ndovu and verify your email.

- Navigate to the “Invest” page to access shares.

- Select any shares of large tech companies you wish to invest in.

- Invest easily via mobile money or bank.

Summary

Ndovu is the ideal investment platform for anyone who wants to kickstart their investment journey. It is particularly attractive to those who want to tap into the U.S. stock market with limited funds. With as little as ksh 1,000 you can immediately get started and this lowers the barrier of entry for most people. Do not miss this chance.

👉 Ndovu Website

👉 Download the App: Google Play / App Store