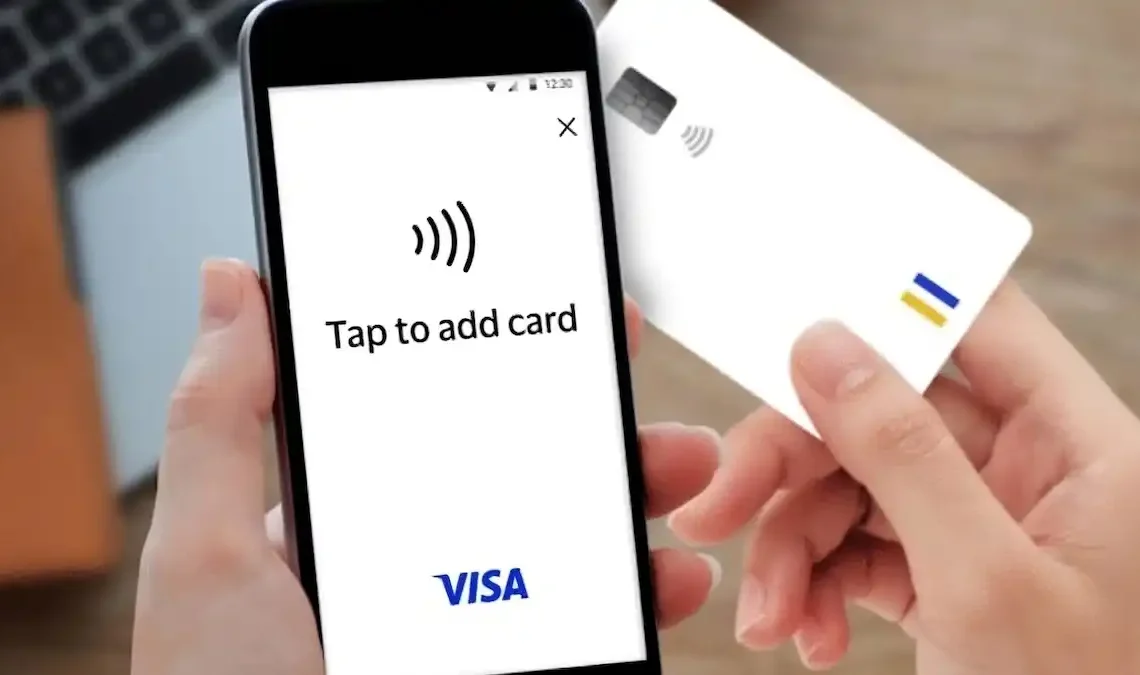

Visa has today launched its Tap to Add Card technology in Kenya. This technology allows cardholders to add their Visa contactless cards to digital wallets with a simple tap on their mobile device. The technology is supported by digital wallets globally, ensuring seamless integration with existing digital wallet experiences.

“We are excited to bring the enhanced security and simplicity of Tap to Add Card to East Africa,” said Chad Pollock, VP and General Manager, Visa East Africa. The solution provides cardholders with greater peace of mind when adding a card to a digital wallet, knowing their information is protected by advanced security measures. We believe that Tap to Add Card will be instrumental in driving further adoption of digital wallets in East Africa by addressing key security concerns and simplifying the user experience.”

Tap to Add Card eliminates the process of manual entry, a common source of errors and a vulnerability exploited by fraudsters seeking to compromise sensitive card information. The tap generates a unique, one-time code validated by Visa’s Chip Authenticate service, ensuring secure provisioning of card credentials and offering a significantly faster and more secure alternative to traditional methods.

Benefits of Tap to Add Card

Tap to Add Card is beneficial to all stakeholders in the payments ecosystem. It offers an experience similar to in-store payments, cardholders can enjoy a faster, more convenient, and more secure way to add cards to their digital wallets, encouraging greater adoption of digital payments.

For issuers, Tap to Add Card can help reduce the risk and associated costs of provisioning fraud, simplifies the add-to-wallet process leading to fewer customer service inquiries, and improves transaction approval rates.

Similarly, for digital wallets, Tap to Add Card follows Visa security standards, reducing the risk of card compromise and promising a potentially higher token provisioning rate due to fewer card entry errors, while also presenting the opportunity to introduce new customer experiences.

Also Read: Visa Appoints Michael Berner as Head of Southern and Eastern Africa