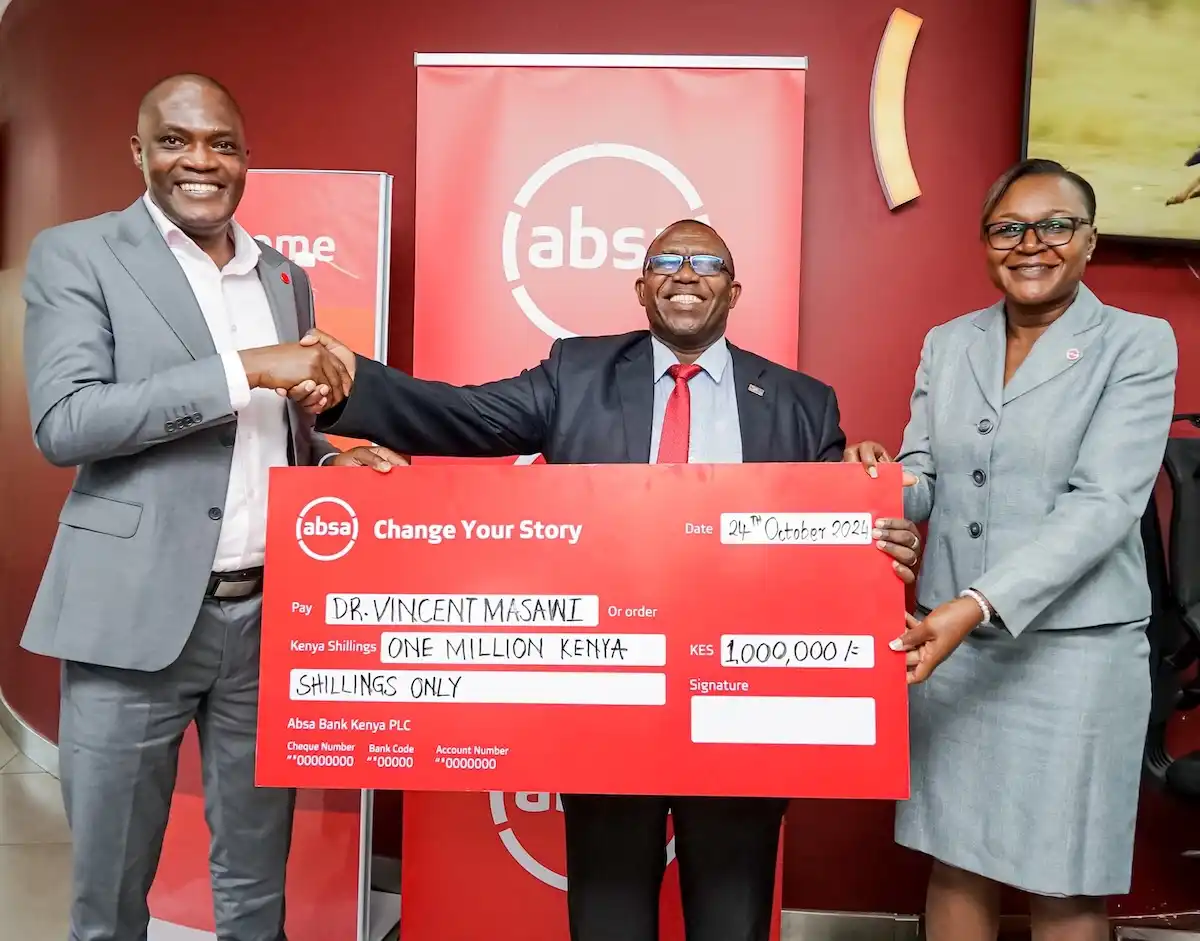

Absa Bank Kenya has announced the first winner in the Change Your Story card campaign that kicked off in September. The campaign is ongoing and will end on 31st December 2024.

The campaign seeks to encourage consumers to use digital channels and card payments. This is part of Absa’s broader commitment to advancing financial inclusion and improve customer convenience.

Speaking during the awarding at the Sarit Centre Branch, the Absa Bank Kenya Customer Network and Distribution Director Peter Mutua said, “This campaign extends beyond simply rewarding our customers; it’s an invitation for both customers and non-customers to engage with us meaningfully. We encourage everyone to connect with us, explore our offerings, and experience the value we are committed to delivering. At Absa, we are committed to empowering our customers and continue to create innovative and engaging ways to support them towards financial freedom.”

The first winner is Dr. Vincent Masawi who opened his account at the Absa Waiyaki Way branch in 1990 when he used to work for a dairy and farming machinery company after his undergraduate studies.

“I was very happy when I received the call that I would be awarded as the first winner. Absa Bank Kenya has been a worthy financial partner in my journey for the last 34 years and I have been able to grow my business and to educate my children with their support,” said Dr. Vincent Masawi.

“The money is a huge lift, and I will have to put a fraction of it in the business. My last born, who is about to graduate from university, will also benefit from it and of course, God comes first, and so I will give 10 per cent of that money to my rural church as a tithe,” added Dr. Masawi.

Absa Bank Kenya will unveil a grand winner monthly in the card campaign set to end in December 2024. The Bank customers and non-customer qualify for the campaign when they use the lender’s point of sale or digital platforms to pay at least KES. 1000 with their debit or credit card or create an Absa account or register for an Absa card, deposit at least KES. 10,000 into their savings or current account, or, complete five digital financial transactions per week, to be eligible for the draw.

Also Read: Absa Kenya Foundation Launched to Drive Societal and Environmental Impact