M-Pesa Fuliza, for those who don’t know, is an overdraft facility for M-Pesa users in Kenya. Fuliza was first released back in 2019 and is not a loan facility but an overdraft facility. There are charges associated with using Fuliza and the exact amount varies depending on the amount. You can get any amount between Ksh 1- 70,000.

With Fuliza, you can complete M-Pesa transactions even when you have insufficient funds in your account. Most of us have been in that situation where you want to buy or pay for something only to realize you don’t have enough in your account. This is what Fuliza is supposed to address.

Who is Eligible to Use M-Pesa Fuliza?

Fuliza is accessible by any M-Pesa user who has registered using their national ID/Kenyan passport/Military ID. You also need to have been actively using your line for at least 6 months. M-Pesa users who have registered using foreign passports cannot opt-in to Fuliza.

How to Opt into Fuliza

Opting into Fuliza is quite easy, all you have to do is:

- Dial *334#.

- Select Loans and Savings

- Select FULIZA

- OPT in

You can also use the MySafaricom app to activate Fuliza.

How to Use M-Pesa Fuliza

Once you opt-in, Fuliza will always kick in automatically when you do not have enough balance for a transaction. You will still get a prompt to confirm when your are about to use Fuliza to complete a transaction.

Fuliza can be used to:

- Pay to Lipa Na M-Pesa including Buy goods and Paybill till numbers.

- Send Money to both registered and unregistered customers.

- Buy airtime using the USSD code or through the M-Pesa app.

- Withdraw funds from an M-Pesa agent.

How to Repay Your Fuliza Balance

Repaying your Fuliza balance is also automatic as amount will be deducted from your M-Pesa as soon as you receive money in your account. It can be deducted in fractions till the whole Fuliza balance owed is settled.

You have 30 days to repay your balance. If you have unpaid balance after 30 days, you will not have access to your Fuliza M-Pesa limit. This will be restored once you repay your balance.

Fuliza Charges and Fees

Accessing the Fuliza overdraft facility attracts a daily maintenance fees based on your outstanding balance. There is also an excise duty that varies depending on the outstanding balance. Have a look at the different Fuliza charges below.

| FULIZA TARIFF | |||

| Band | Tariff | 20% Excise Duty | Total Charges |

| 0 -100 | KSh 0 | KSh 0 | KSh 0 |

| 101-500 | KSh 2.5 | KSh 0.5 | KSh 3 |

| 501-1000 | KSh 5 | KSh 1 | KSh 6 |

| 1001-1500 | KSh 18 | KSh 3.6 | KSh 21.6 |

| 1501-2500 | KSh 20 | KSh 4 | KSh 24 |

| 2501-70000 | KSh 25 | KSh 5 | KSh 30 |

Managing Your Fuliza Limit

If you have a Fuliza limit, the amount can go up or lower depending on how you use the service. You can check your Fuliza limit by dialling *234# or through the M-Pesa and MySafaricom apps.

To raise your limit, Safaricom recommends you use M-Pesa services frequently and repay your Fuliza on time. The opposite will lower your limit. There have been rumours that if you opt-out of Fuliza then opt-in again will raise your limit. This is not true as some people have had their limits go to 0 after doing this.

When You Should (or Shouldn’t) Use Fuliza

It is important to exercise discipline when using Fuliza. It should be perfect for emergency payments and small purchases. This is when you need to make the payment and do not have the total amount. It should also be used when you expect to get the money to pay back the balance as the fees can accumulate.

Avoid relying on Fuliza as the fees can add up and this may lead to long-term financial strain. Use it for payments that you need and not luxuries.

How to Opt-Out of M-Pesa Fuliza

You can easily Opt-out of Fuliza through a USSD code or through M-Pesa app or MySafaricom app.

How to Opt-Out of Fuliza through the USSD (*234#)

- Dial *234#

- Choose Fuliza M-Pesa (option 0)

- Select ‘Opt-out’ (This is option 7).

You will get a screen prompt letting you know that your Fuliza limit will be reset to 0.

Confirm that and then proceed and you will have successfully opted out.

How to Opt-Out of Fuliza through the MySafaricom APP

- Open the MySafaricom app

- Go to the ‘M-Pesa’ tab

- Tap on ‘Fuliza M-PESA’

- You will see a button at the bottom labelled ‘Opt-Out’

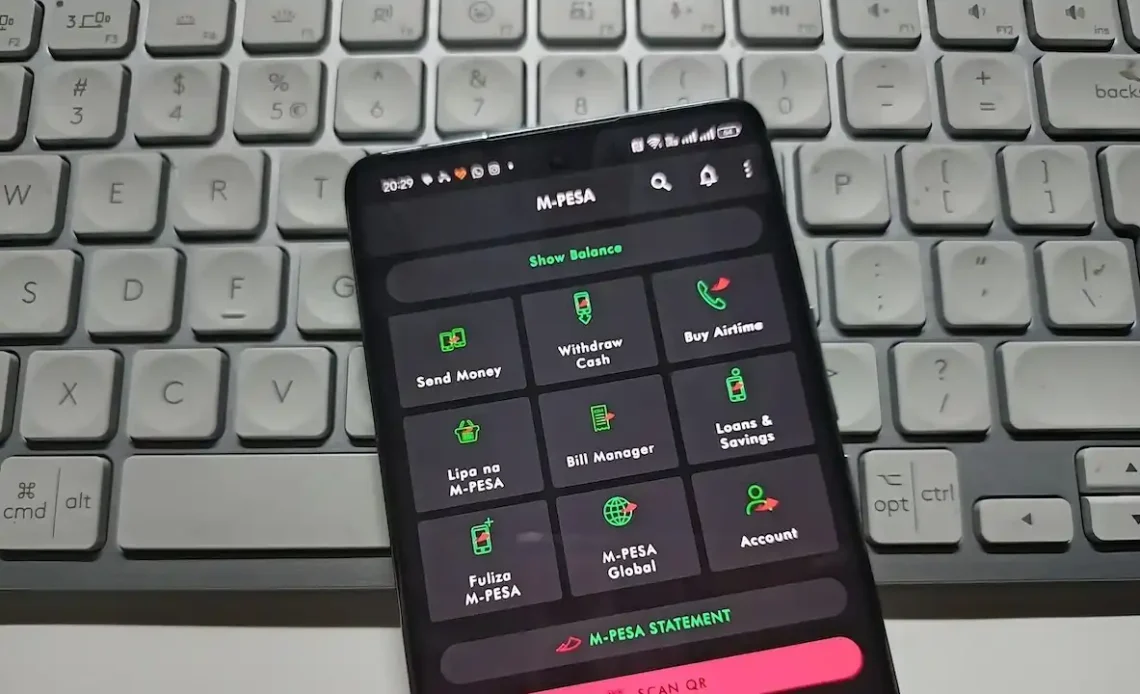

How to Opt Out of Fuliza through the M-Pesa App

- Open the M-Pesa app

- Find the Fuliza Menu under Financial services.

- Open Fuliza and tap on the three dotted menu on the top right section and select opt-out.

Summary

Fuliza is a fantastic product when you are running low of cash and want to make a purchase or payment. It should be used wisely and try not to rely on it. If you use it, try make the repayments in time to keep your limit and avoid high fees. Having a good limit also means that you can access the facility when in need at a future date.