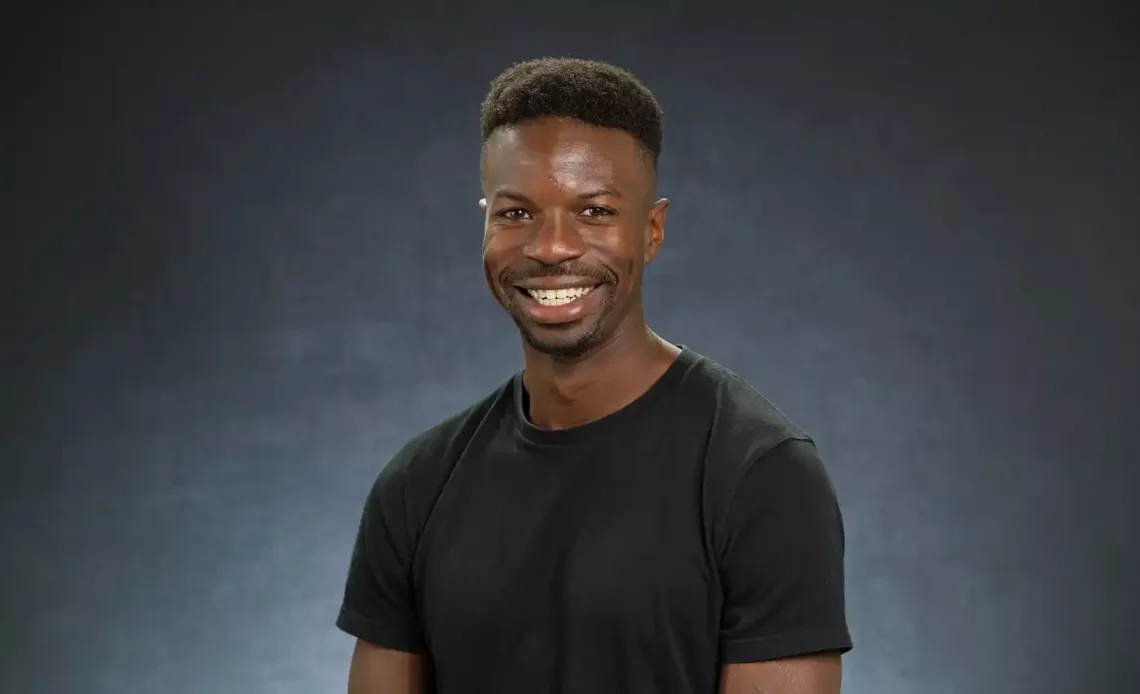

The African startup funding scene is quite dynamic. In a conversation with Efayomi Carr, Principal at Flourish Ventures, I wanted to understand the state of funding in Africa and what we can expect this year. Flourish backing mission-driven entrepreneurs who are working towards a fair financial system.

As we explore key insights drawn from our interview, discover the perspectives that paint a picture of the challenges faced by entrepreneurs and the strategic initiatives undertaken by Flourish Ventures to navigate the dynamic ecosystem.

TechArena: How would you describe the current state of the startup and funding landscape in Africa, especially in the regions Flourish Ventures operates?

Efayomi Carr: Africa tech funding saw a significant decrease in 2023. As a result, entrepreneurs found it more difficult to raise capital and experienced uncertainty about the future of their businesses. Many startups shut down in 2023 due to a lack of funding. These challenges were elevated in Flourish’s priority markets: Egypt, Nigeria, Kenya, and South Africa all experienced macroeconomic turbulence and uncertainty over the past 18 months.

TA: Are there any notable trends in terms of the types of startups or industries that are attracting funding in Africa?

EC: Climate technology has emerged as a breakout sector with significant funding and global interest. Renewables, mobility, and related climate resilience sectors are attracting substantial investments. Sectors like fintech remain a focus, with adjacent industries such as embedded finance in B2B commerce also gaining attention. Developments in carbon credits and climate adaptation present significant market opportunities. Renewables, led by solar, and EVs are leading the expected increase in clean energy investment in 2024

TA: What challenges do startups in Africa commonly face when seeking funding, and how is Flourish Ventures working to address these challenges?

EC: Startups often face challenges in funding due to economic instability, market uncertainties, and changing investor behaviour. Flourish adapts its investment strategies, focusing on sustainable growth, profitability, and strategic positioning for exit. Flourish supports companies across the fundraising cycle and emphasises sustainable business models and market alignment.

TA: From your expertise, what are the key opportunities for growth and innovation in the African startup ecosystem?

EC: Flourish focuses on fintech investments, and we see many opportunities in the space. Several trends in Africa, such as intercontinental trade, merchant digitization, and access to cryptocurrency/ stablecoins, are paving the way for new innovation. As a result, we are seeing opportunities in cross-border payments, b2b finance, and blockchain-enabled technology. We also see green shoots in climate finance. We’ve invested in agtech but continue to see opportunities in carbon credit development, ev/mobility, and renewable energy.

TA: In your experience, how supportive are local governments and regulatory bodies in creating a conducive environment for startups and attracting investment in the regions Flourish Ventures operates?

EC: Government support varies across markets, influencing the startup ecosystem. Positive government policies and initiatives can create a conducive environment for startups and investment. Engagement with regulators and policymakers is crucial for creating a supportive ecosystem.

TA: Are there specific initiatives or policies that could further enhance the startup ecosystem?

EC: There is a lot of diversity across the continent – African governments are generally keen on supporting tech startups. Policies promoting innovation, entrepreneurship, and sustainable finance can enhance the startup ecosystem. Collaboration between government, investors, and stakeholders can drive impactful initiatives – it’s always important to receive each parties’ alignment and agreements. Collaborative efforts can also help address challenges like access to capital and talent shortages. Robust KYC regulations can instil confidence among investors seeking to inject capital into startups. This confidence can lead to increased investment flows and support for promising ventures.

TA: What is Flourish Ventures’ outlook for the future of startups in Africa, both in the short term and long term?

EC: In the short term, the landscape may be challenging due to economic uncertainties and market volatility. In the long term, we believe the outlook is bright for Africa: there is a strong talent pool, increased digitization, and new sectors for innovation, such as climate. Flourish remains committed to supporting startups that align with its mission of fostering a fair financial system and sustainable growth. By investing in startups with innovative solutions, we aim to contribute to a more inclusive and sustainable future where financial services are accessible and can improve business’ and consumers’ day-to-day lives.

Also Read: Flourish Ventures Takes a Bold Move to Shine a Spotlight on African Tech Founders’ Well-being