Safaricom Ethiopia launched M-Pesa back in 2023 after obtaining the necessary license from the National Bank of Ethiopia. Uptake was quick reaching over 3 million M-Pesa users out of over 5 million total subscribers.

Even with the impressive numbers, M-Pesa’s growth in Ethiopia is still slow as the country relies on cash for most transactions. Safaricom says the use of cash for small transactions is quite a big challenge to its expansion. This is the opposite of what is seen in markets like Kenya where M-Pesa is embraced even for small transactions.

The telco said this during the second investor day adding that, “Banking penetration in urban areas is relatively high but 99 percent of small value transactions are in cash.”

The sentiments have been echoed by the World Bank report on Financial inclusion and digital payments released in 2021. There is still a huge gap in the market as mobile money could add up to $5.3 billion to Ethiopia’s GDP according to the GSMA.

Less than half of Ethiopian adults had mobile money or bank accounts as of 2022 according to the Global Findex. This is low compared to other East African countries with 80% of Kenyans having access to mobile money or bank accounts. 77% and 66% of adults in Rwanda and Uganda respectively have access to these financial services.

Safaricom also notes that almost all adults in Ethiopia pay their utility bills with cash. “Most people still rely on cash to pay utility bills and receive payments. Almost all adults at 99 percent pay utility bills with cash, compared to 12 percent of people in Kenya and 59 percent in the region as a whole,” the company said.

Ethio Telecom Still Leading

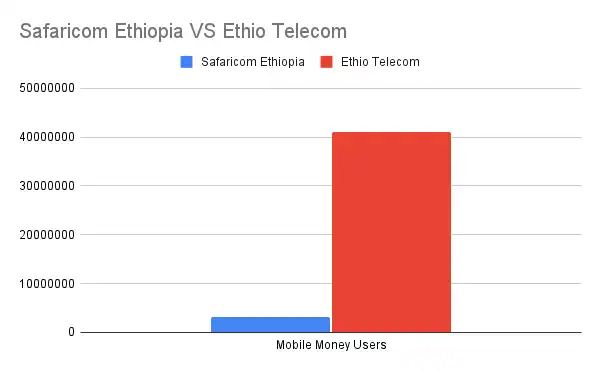

Even as Safaricom faces these challenges, its rival, Ethio Telecom, is still the mobile money leader with over 41 million customers for the financial period ending December 2023. During the 6 month period, its mobile money payment service, Telebirr, saw it total transaction value reach 910.7 billion (approximately Ksh 2.3 Trillion).

Safaricom has some catching up to do and has to figure out ways to offer attractive service to those who rely on cash for most transactions.

Read: Safaricom Partners With Sumitomo Corporation to Launch Spark Accelerator Program

image source: GSMA