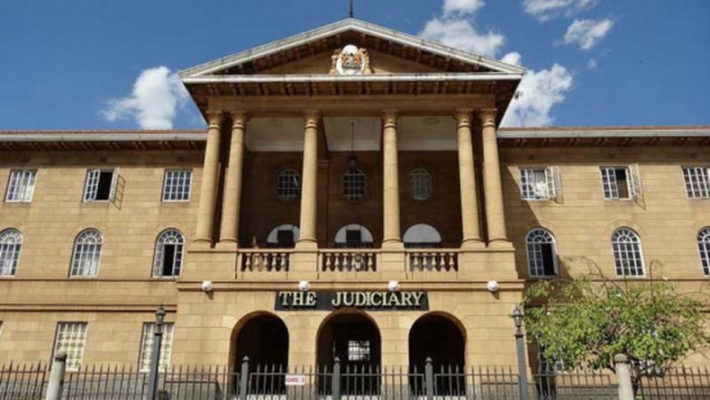

Yesterday, the High Court of Kenya issued an interim order suspending the reintroduction of bank-to-mobile money charges by Safaricom and the Central Bank of Kenya (CBK). The order was issued in response to a petition filed by a Nairobi resident, Mr. Moses Wafula, who claims that the charges should not be passed on to consumers. This ruling effectively stops the reintroduction of charges between mobile money wallets and bank transactions as advanced by the CBK through a press release issued on December 6, 2022.

The reintroduction of these charges was a result of a notice issued by the CBK on December 6, 2022, which stated that the charges, which were waived on March 16, 2020, as part of emergency measures to facilitate the use of mobile money during the height of the Covid-19 pandemic, would be reintroduced on January 1, 2023. This notice prompted payment service providers and banks to announce revised transaction charges before the start of the new year.

Mr. Wafula argues that it is illegal for the banks to continue using the M-Pesa Paybill infrastructure and making money from members of the public without paying for it. According to him, charges incurred in M-Pesa Paybill services are to be paid for by Safaricom’s primary clients, such as banks, and not by the consumers. He also claims that his rights, and those of other members of the public, have been violated, infringed, and continue to be threatened by the giant telecommunication firm and the Government of Kenya in view of the directive issued by the CBK. He absolutely makes sense here as I do not see why the charges are re-introduced as the banks recorded huge profits when the charges were suspended DURING THE covid-19 pandemic.

In his petition, Mr. Wafula argues that M-Pesa Paybill services being an outsourced service, “Safaricom has no authority to charge members of the public for a service offered to its contracting service recipients including banks”. He also contends that the engagement between Safaricom and its M-Pesa Paybill clients (such as banks, government agencies and other institutions) is a bipartite business engagement between Safaricom as the M-Pesa Paybill service provider and their M-Pesa Paybill primary clients being the service recipients.

The Banks being one of the Safaricom’s Mpesa Paybill primary clients also elect to pass the Safaricom Mpesa Paybill charges to the members of the public (the Safaricom clients’ customers),” he argues.

The High Court’s ruling to suspend the reintroduction of bank-to-mobile money charges is a significant development in the ongoing debate over financial consumer rights in Kenya. The petition filed by Mr. Moses Wafula raises important questions about the legality of the charges and the authority of Safaricom to impose them on consumers. The outcome of this case will have a significant impact on the future of mobile money transactions in Kenya and the rights of consumers in relation to these transactions. The case is set to be mentioned on January 23, 2023, and the outcome will be closely watched by the public and stakeholders in the mobile money industry.

I will update you on the outcome as soon as we have it.

Read: Why Safaricom is Introducing Expiring Bonga Points