Safaricom has recently added a new feature to its overdraft facility, Fuliza, which allows customers to withdraw cash from the service. This feature has been available for a couple of weeks but the telco has not officially announced it yet.

Safaricom’s Fuliza service has been widely adopted by customers in Kenya and has grown to be a household name. The service, which was launched in 2019, allows customers to access an overdraft when they don’t have enough funds in their account.

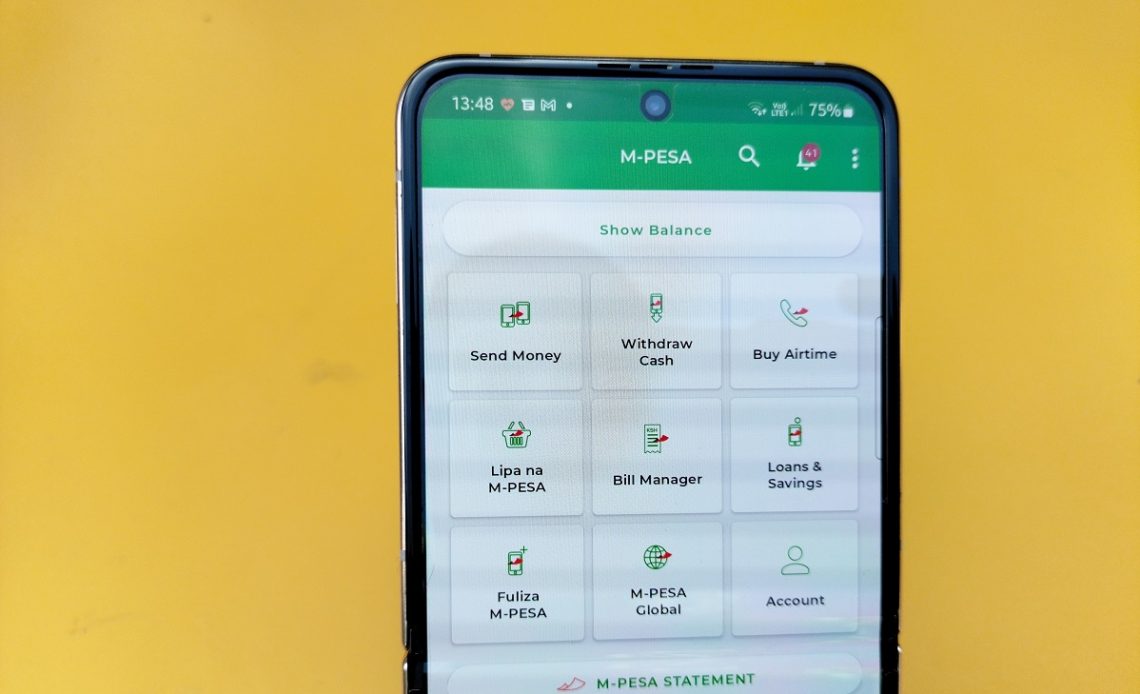

Previously, Fuliza was only limited to certain use cases such as sending money, using Lipa na M-PESA services like Paybill and Buy Goods, and buying airtime.

One of the key challenges with Fuliza was that customers couldn’t withdraw cash from the service, which led to issues with people having to send money to others so they could access cash. With the new feature that allows customers to withdraw cash from Fuliza, this problem has been addressed and the service is now more functional.

This new addition expands the functionality of Fuliza and eliminates the need for customers to tell a sender not to send money to them because they have an overdraft.

Fuliza has been one of Safaricom’s biggest earners and has overtaken the likes of KCB M-PESA and M-Shwari in terms of earnings.

Recently, Fuliza rates have also been adjusted downwards, a move that is meant to get more people to use the product.

Overall, the new feature to allow customers to withdraw cash from Fuliza is a major step forward for the service. It addresses a key challenge that customers were facing and makes the service more functional and accessible. With the expansion of the service to more people and the lower rates, Fuliza is set to continue its success in the Kenyan market.

Read: Safaricom to reduce Fuliza daily fees by up to 40% from October