Safaricom has announced that from next month, Fuliza daily maintenance fee for amounts between Ksh 100 and 1000 will be reduced by 40%. There is no fee charged for those who overdrafting anything below Ksh 100 but those who overdraft Ksh 101 to Ksh 500 will be charged a daily maintenance fee of Ksh 3. This is down from the current Ksh 5 charged each day. For those seeking amounts between Ksh 501 to 1000, the fee is Ksh 6 per day.

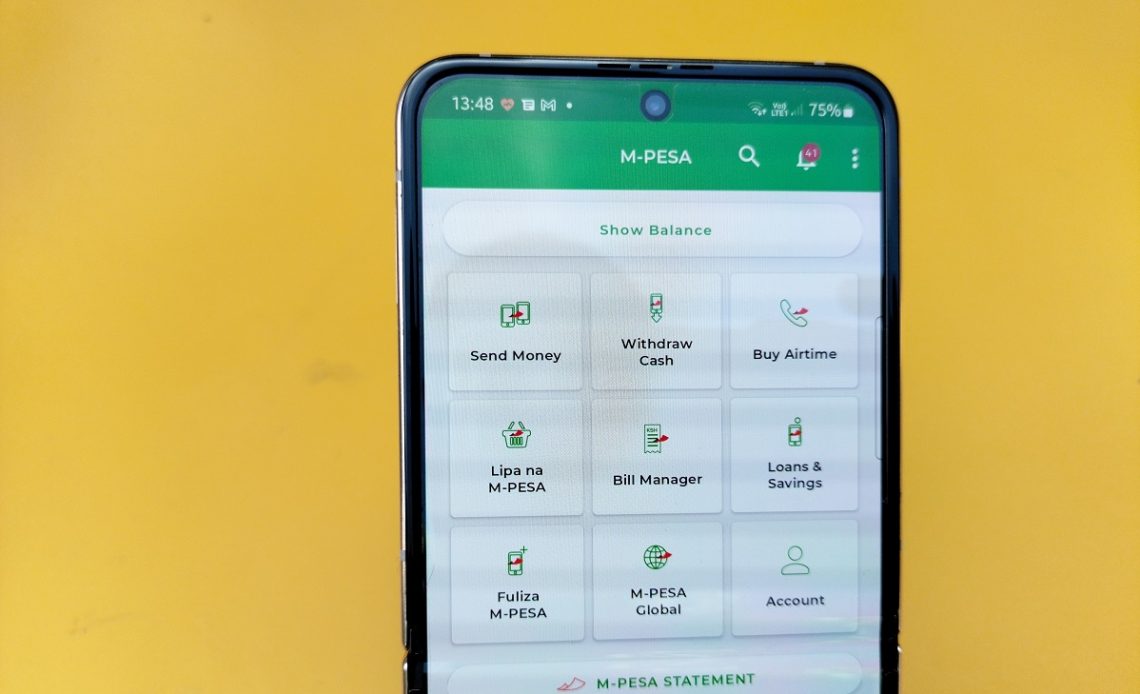

Fuliza has always come under attack from being expensive and exploitative. Even though Safaricom has argued that it is not a loan product, this hasn’t spared it from attacks from those who do not want to hear any of that. To be honest, It has been quite expensive. Charging Ksh 5 per day for amounts below Ksh 500 is a bit high. If you repay the amount in say about 15 days, you will end up paying quite a huge amount to be honest. It is good to see the rates come down finally.

Safaricom has also said that those overdrawing amounts below Ksh 1000 will get a waiver on daily maintenance fees for the first 3 days.

For those who will be seeking between Ksh 1001 and 1500, they will be getting a 10% reduction in the daily fees and will be required to pay only Ksh 18. For Ksh 1501 to Ksh 2500, the fee will be Ksh 20.

A fee of Ksh 25 will be charged for those seeking amounts between Ksh 2501 to Ksh 70,000. This represents a 16.7% reduction from the current fee.

Fuliza overdraft fees summary

| Amount | Daily Fee |

| Ksh 100 and below | 0 |

| Ksh 101 to 500 | Ksh 3 |

| Ksh 501 to 1000 | Ksh 6 |

| Ksh 1001 to 1500 | Ksh 18 |

| Ksh 1501 to 2500 | Ksh 20 |

| Ksh 2501 to 70000 | Ksh 25 |

Old Tariffs apply to active overdrafts

The old Fuliza tariffs will apply to those who have active Fuliza overdrafts as of October 1st. The new rates are only applied to new overdrafts from the beginning of the month. You will be able to get the new tariffs once you pay existing Fuliza debt.

Fuliza’s ownership consists of Safaricom and NCBA who each own 40% while KCB owns the remaining 20%.

Read: These are the 10 Mobile Loan Lenders Approved by the Central Bank of Kenya