Safaricom has announced a new partnership with VISA that will see the launch of the M-Pesa VISA Virtual card in Kenya. You can think of a virtual card as a digital card that is designed for transactions without you having to use your bank’s debit or credit card. Since the virtual card launched by VISA and Safaricom is linked to M-Pesa, you will need to have money in your M-Pesa account for you to make payments.

The virtual card will work like any debit or credit card that you can have. This virtual card is different from the other M-Pesa prepaid cards that we have seen launched in partnership with local banks before. Whereas with those you were required to have a physical card, with this one there is no need of one.

The virtual card works with your M-Pesa wallet and that means that all you have to do after activating it is ensure you have some money in your M-Pesa wallet.

Why the M-Pesa Virtual card exists

With many Kenyans using services like PayPal or purchasing products on platforms like Amazon, having a virtual card allows you to pay for these since some of the international services do not accept M-Pesa as a form of payment. A virtual card is convenient for most Kenyas who are already using M-Pesa and may want a card that is convenient for such.

There is no application fee to get this virtual card as all you need is a Safaricom SIM card with M-Pesa activated.

How to create and activate your M-Pesa Visa Virtual Card

Creating an M-Pesa Virtual card is simple and straightforward as long as you have a Safaricom line and are using M-Pesa:

- Open the M-Pesa App on your phone.

- Tap on the ‘Grow’ tab on the bottom right corner.

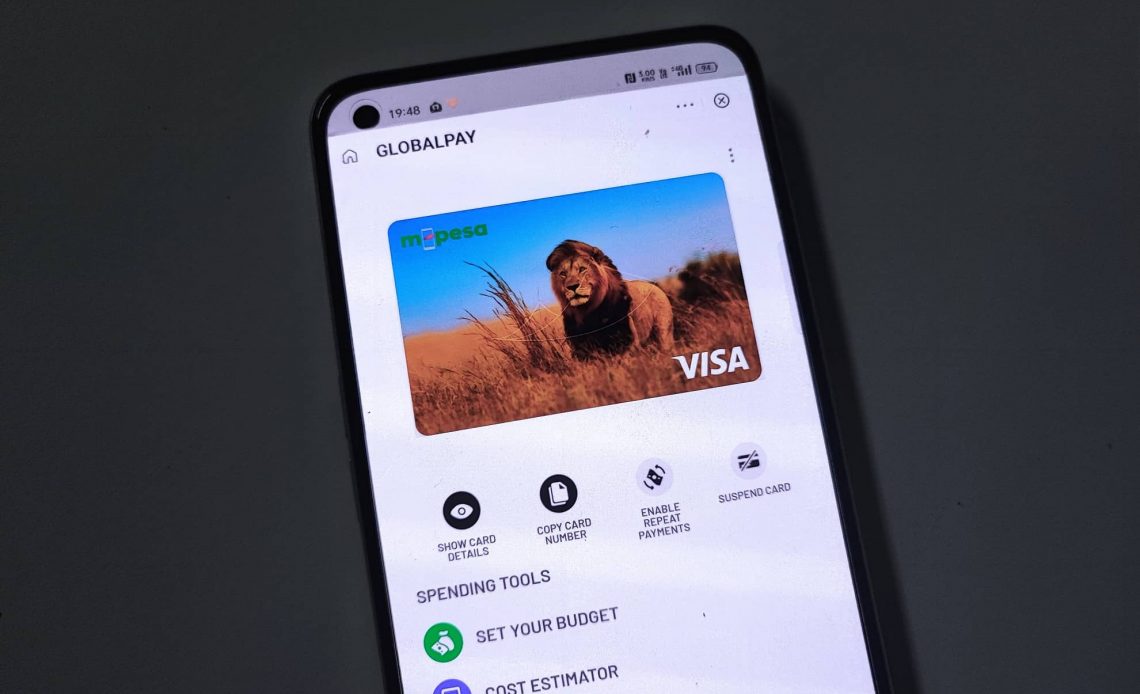

- Tap on ‘Global Pay’ and follow the on-screen prompts.

- You will be able to customize your virtual card with different colours and images.

- You will get an SMS with your card number and expiry date.

Once done, you can see your card details including the CVV number on the M-Pesa app. The CVV is generated by the customer during the payment process, to verify the payment. All CVV generated will only be valid for 30 minutes. This will prevent anyone who has your card details from using your card because they may have to generate another CVV.

You can set your budget, enable repeat payments and suspend the card right on the app.

https://twitter.com/TechArena_KE/status/1532408740124807169

You can also set up your card via a USSD code:

- Dial *334#

- Select Lipa na M-PESA

- Select M-PESA GlobalPay

- Accept terms and conditions

- Enter M-PESA PIN

- You will receive a 16-digit number in a flash SMS. This is your M-PESA GlobalPay Visa credential (PAN)

- You will also receive the validity period of the card in a separate flash SMS.

What are the charges for using M-Pesa VISA Virtual Card?

According to Safaricom, there will be no charges for using the card but prevailing forex rates apply. Safaricom will also apply a Forex Exchange markup of 3.5% on the prevailing forex rate to exchange from billing currency (Ksh) to the currency at the time of purchase.

Important Points to Note

- The M-Pesa VISA Virtual card only works with international payments to services like Netflix, Spotify, Amazon etc. It will not work with your local eCommerce platform like Jumia, Masoko etc. For those, you will have to use Lipa na M-Pesa.

- Fuliza will not be available for M-PESA GlobalPay Payments.

- The virtual card does not store your money as it just mirrors your M-Pesa balance.

- The card is valid for 3 years.

Read: Little and Makao Mini Apps are now available on the M-Pesa Super App