Yesterday, HFC, the banking subsidiary of HF Group, unveiled its digital financial service platform it is referring to as HF Whizz. This is a first for the company and we will be looking at the app to see what it has to offer and if it is an app you should be using. In this day and age, we spend most of our days on our phones and it makes sense for companies to come up with products and services that take advantage of that.

As a smartphone user or someone who may be interested in such an app, you may be wondering, why does this app exist? What does it offer? Is it for me? Do I even need it? These are the questions I will try and answer later in this post.

Speaking about this app, HFC Managing Director Sam Waweru said, “Through HF Whizz, we want to deliver a frictionless digital experience across all our customer touchpoints with greater agility. It is our vision that the digital banking platform will enhance our customers experience, provide comprehensive business functionality and drive profitability.” Is this what the app offers? Let’s find out.

The Target Market

HFC was very clear that with this app, it is targeting the youthful hustlers and micro entrepreneurs. These are the young people who need banking and financial services but are not targeted by most financial institutions and products out there. Think of the ‘Mama Mboga’ who has a stall in your neighbourhood. She does need save money, send & receive money, borrow money, pay bills etc but she is not the ideal target market for most financial institutions.

Even with that said, the HF Whizz app is not limited to the ‘Mama Mboga’, it does target those who don’t just want a digital banking platform but one that offers a frictionless experience.

What Does HF Whizz App Offer?

So, what will you be able to do with the HF Whizz app?

After you’ve downloaded the HF Whizz app, you will go through the sign-up process that is straightforward and takes a few seconds. You will be able to open an account in an instant just by using your phone number and ID number. There is no need to go to the bank for this as you can do everything through the app. The HF Whizz app is the first to be regulated and approved by CBK to allow opening and operating accounts without any paperwork. This means that the account you get through this app is not just a mobile based one but it is a functional account that you would have gotten if you went to the bank.

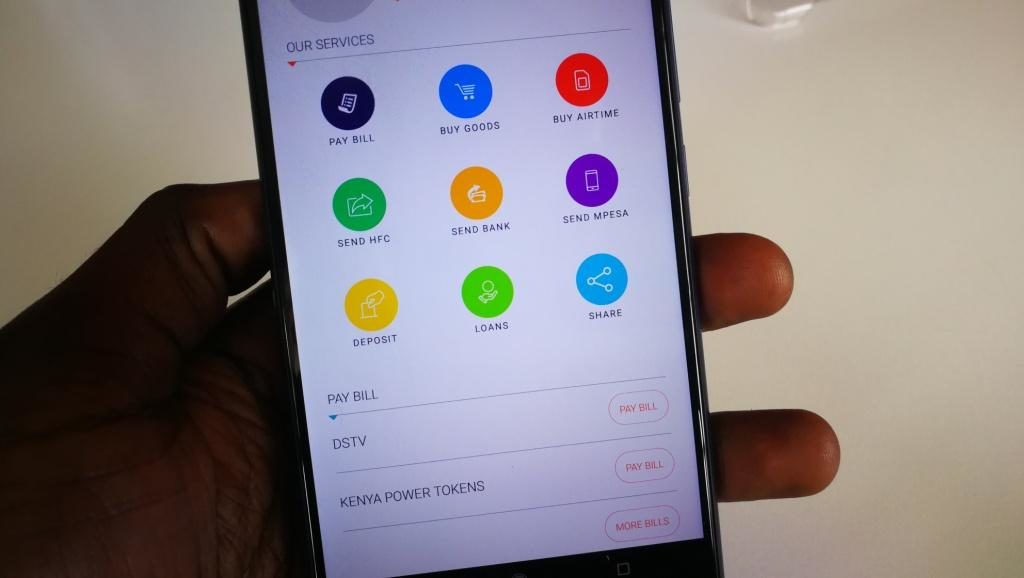

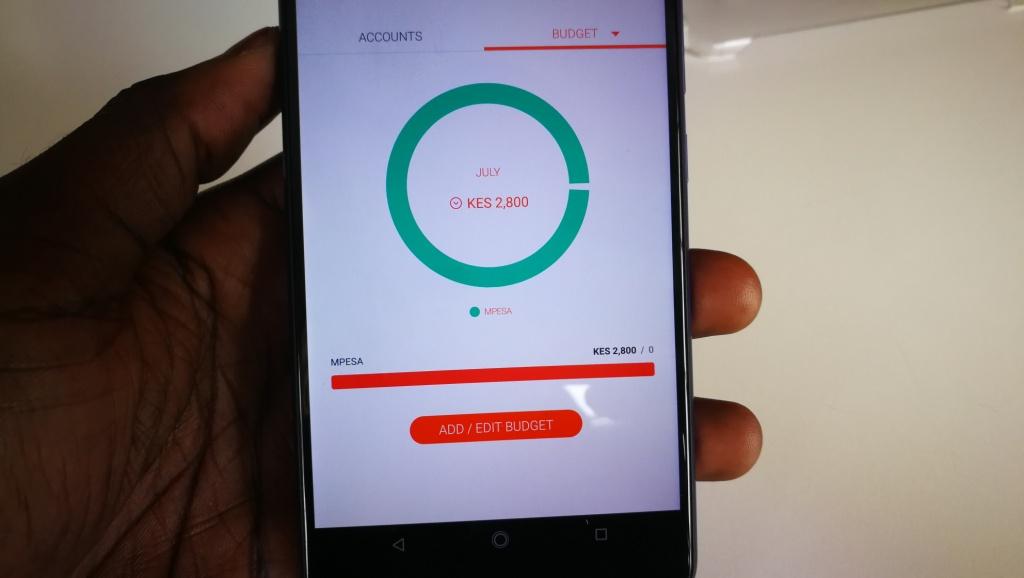

Once you have everything setup, you will be taken to the home screen when you will see all the services available to you. The first thing you can and should do is load money to your account. This process is easy and all you have to do is tap on the “Deposit” icon on the home screen. You do not have to leave the app to do this, just tap on Deposit and you will be taken to a screen where you put in the amount you want to transfer from M-pesa to your account. M-Pesa’s STK Push comes into play here so you do not have to remember the M-Pesa pay bill details as those will be prefilled and you will get a pop-up notification to enter your PIN to confirm the transaction and the amount will be moved to your account immediately. There is no minimum account balance so you can have as little as you want to.

With the money in your account, you will be able to use it to pay your bills, buy goods, buy airtime, send M-Pesa, send to other people using HFC or those in other banks through RTGS or Pesalink. The pay bill option is the exact one you may have seen before if you use M-pesa. You get a few pre-populated services such as DSTv, GOTv, Kenya Power, Nairobi water etc to make the process simple for you. If your service provider is not listed here, you can enter their Pay bill number, your account number and amount just as you have done before with M-Pesa. The buy goods option is also what we have used on M-Pesa before. If you get to an establishment that accepts payments through M-Pesa, just enter the details and instantly pay without leaving the app.

If you happen to run out of airtime on your phone, you will be able to use the HF Whizz app to load it on your phone or load it to someone else’s phone if you want to do so. All this is supposed to happen without you leaving the app and this is part of the seamless experience the app is promising. The same is the case with sending to M-Pesa from the app. You can send money from your HFC Whizz account to your own M-Pesa account or to someone else’s M-Pesa account. If you regularly send money to family members, you may find this feature handy, just a few taps and you send money from your account. To send money to M-Pesa, you will be charged a flat rate of Ksh 66. For example, if say you are sending Ksh 5,000, the transaction cost will be Ksh 66 and you will be informed of this before you send.

Sending money to HFC accounts or to other banks is not any different. Just tap on the icon you want and you will be required to enter the details of the recipient including the account number, name and amount. There is no charge for sending money from your HFC account to another HFC account.

Loans and Savings

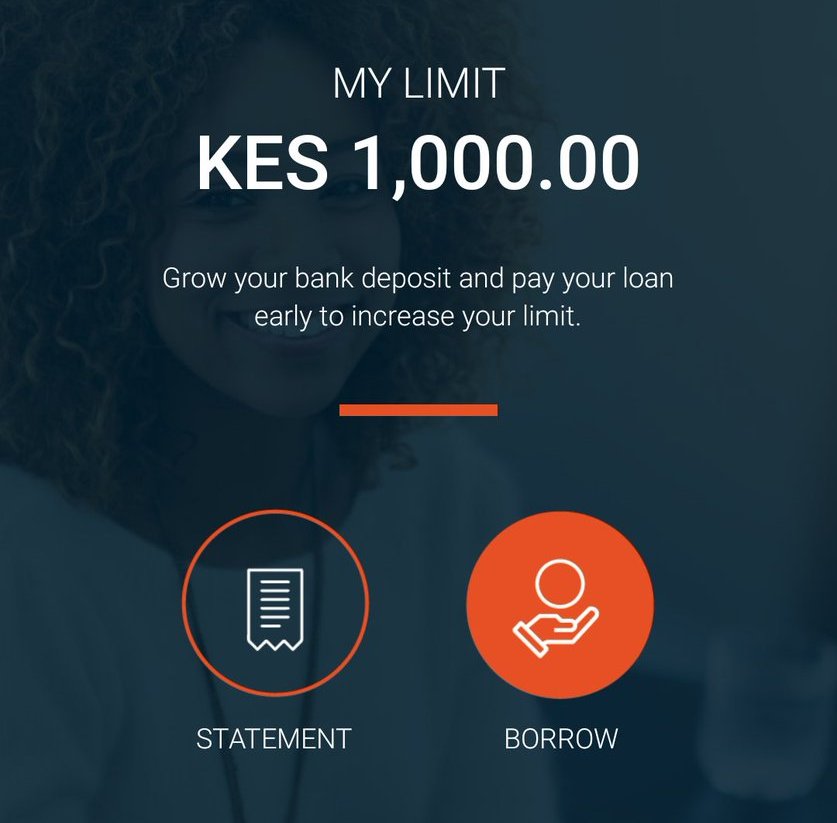

The HF Whizz app also lets you save money and take out loans if you wish to do so. You will actually be able to apply for an instant loan after you download and setup the account for the first time. HFC isn’t just about lending for the sake of it, the company was clear that it supports ethical lending and good credit. This makes sense for the young entrepreneurs who do not want a bad credit as this may affect their business and access to loans and credit facilities in the future. The loan limit is calculated before you borrow and as with other services, will go up the more you borrow and pay on time and also as you grow your bank deposit. This means that if you want to increase your loan limit, keep using the app and most importantly use it to save when you can. My loan limit is Ksh 1,000 and this is what I got the very first time I installed the app.

Before you initiate the loan request, you will get a pop-up notification with the amount you will be required to pay as interest and the actual amount that you will be getting. I find this useful as there will be no surprises in the future. At the moment, the maximum amount you can borrow is Ksh 10,000 but I am sure the limit will go up as time goes by.

And there you have it, the new HF Whizz app, get the app from the Play Store here, open an account, use it to send money, buy airtime, pay bills and let me know how the experience is for you as it has been smooth for me so far.