Africa’s innovators and start-ups will have the ability to scale their ideas in new markets following the launch of Rise, a physical and virtual community that facilitates collaboration and fintech innovation.

Funded by the Barclays Africa Group, Rise is ideally positioned to take advantage of technology solutions that are not reliant on physical infrastructure. This is particularly relevant in the African context as it provides developing markets with an opportunity to leapfrog ageing analogue infrastructure deployed in most developed economies and with it the ability to solve some of Africa’s development challenges.

The ability to bring scale to new ideas has long been at the centre of the Barclays proposition. By connecting the world’s most active innovation ecosystems, Barclays is confident that Rise can assist in co-creating ground-breaking products and services with entrepreneurs from across the continent.

“The financial services industry is undergoing a paradigm shift and new tech start-ups are challenging traditional business models,” says Ashley Veasey, Chief Information Officer of Barclays Africa. “This is possible, in principle, because advances in technology are enabling bright minds to develop solutions that compete with the best of those developed by big corporates. We aim to partner and collaborate at the forefront of this change.

In addition to the digital platform, Rise has physical innovation hubs in London, Manchester and New York, and is set to open one in Cape Town in December. With over 5 000 start-ups interacting through the Rise London and Manchester hubs in the first year alone, over 20 hackathons being hosted and over 130 companies having made use of the global sites, Rise Cape Town is set to enable Africans to connect, co-create and scale the next big thing in financial services.

The Cape Town hub will be home to a number of open innovation programmes including the Barclays Accelerator and includes co-working facilities, a world-class events space, and a bespoke setting for the Barclays Accelerator programme.

Applications are now open for the Barclays Accelerator, powered by Techstars

Several Rise initiatives are already underway in Africa, namely the Tech Lab Africa programme and the Barclays Africa Supply Chain Challenge while applications are now open to companies wanting to participate in the Barclays Accelerator, powered by Techstars.

This programme offers innovators and entrepreneurs unprecedented access to leading thinkers at Barclays and to Techstars’ mentor and investor relationships across 14 locations. This latest Barclays Accelerator programme follows successful programmes in New York and London

“The three-month intensive programme has been designed to accelerate new fintech businesses in delivering breakthrough products to market,” says Veasey. “What we’re offering companies is a seat within a best-in-class accelerator programme, which in turn affords access to data, technology and intensive mentoring from industry experts and key decision makers.”

The programme will culminate in a ‘Demo Day’ to an audience that comprises industry leaders, serial entrepreneurs, senior executives and corporate partners.

“We are excited to launch our third accelerator programme with Barclays which will provide new opportunities to companies interested in leveraging the Cape Town fintech community as well as the larger Barclays and Techstars ecosystems. Barclays has become a true innovation partner to Techstars and is deeply committed to spreading fintech innovation worldwide,” says David Brown, Co-Founder and Managing Partner at Techstars.

Applications are now open until 10 January 2016 at www.barclaysaccelerator.com. The programme will begin on 28 March 2016with the ‘Demo Days’ scheduled for June 2016.

Barclays Bank of Kenya Marketing and Corporate Relations Director, Ms Caroline Ndung’u said, “The significant role played by fintech innovation in addressing socio-economic challenges is very clear in Kenya’s financial industry landscape today compared to the last decade. Through this program, we are leveraging Kenya’s strong start-up ecosystem to provide relevant and transformative solutions to local challenges.”

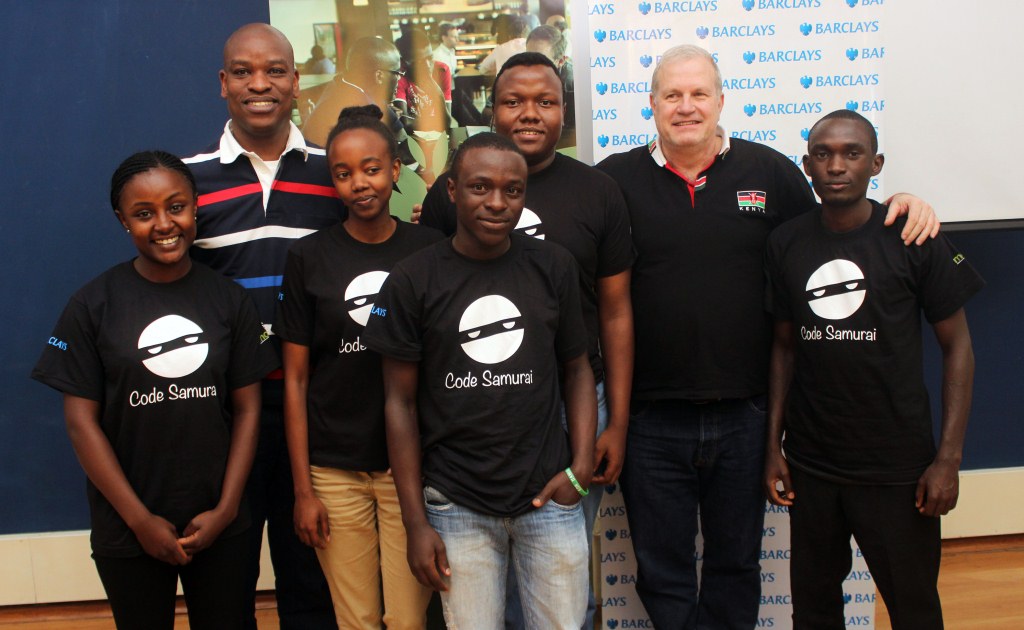

Last week, Barclays, in partnership with East African coding centre Moringa School hosted local developers for a hackathon – a session where developers were challenged to develop financial technology propositions that can potentially revolutionize the bank’s interaction with customers.

While speaking during the event, Barclays Africa Chief Investment Officer, Mr. Etienne Slabbert said the bank is committed to working in partnership with technology leaders to support the development of innovative financial solutions.

“Through this initiative, we are laying the foundation for great ideas, a platform for tech enthusiasts to not only gain skills in fulfilling the dynamic market demands but also showcase the monetary gains that advanced technological standards can have in our country,” noted Mr. Slabbert.