Last week, infotake reported that Equitel had increased its transactions fees by 100% making it quite expensive to use the service compared to other services such as Mpesa. I did not publish this story as there was no official communication from Equitel and since I do not use this service, I could not verify the allegations.

Well, days have passed and Equitel has decided to come out clean and reveal the new transactions fees users can expect when using its services. With releasing these new figures, the company is trying to show how affordable it is when sending money to other banks and to mobile money services (such as Mpesa).

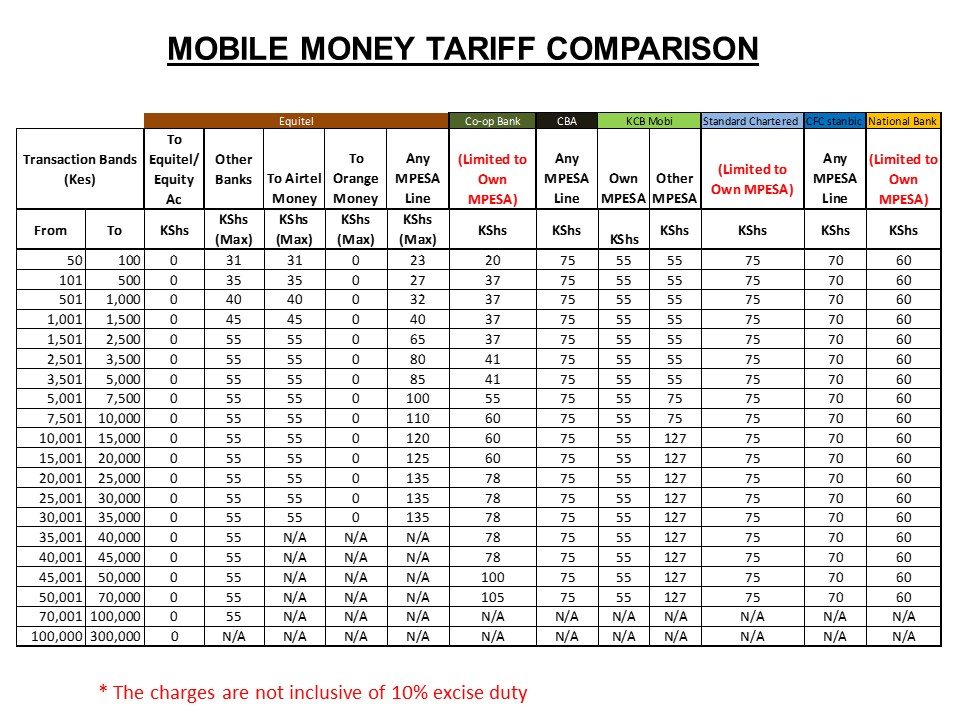

From these figures, you can clearly see that sending money from Equitel to another Equitel user Or Equity account is free. You can send a minimum of Ksh 50 and a maximum of Ksh 100,000.

As for sending money from Equitel to other banks, transaction fees vary between Ksh 31 and 55 depending on the amount you are sending. Note that these fees do not include the 10% excise duty which when included will push them up slightly.

What is interesting with Equitel’s fees is that it costs the same to send to other banks and Airtel Money. Sending to Orange money on the other hand is absolutely free. This does not surprise me, considering that very few people use Orange money.

Sending Money to all mobile money services is capped at Ksh 40,000. For those who will be sending money to Safaricom’s Mpesa, you will pay the most as the transaction fees range from Ksh 23 to 135. Check out the table below.

Safaricom Making It Hard For Equitel

From the table above, it’s clear that it’s expensive to send from Equitel to Mpesa. This makes sense as Safaricom wants to prevent its customers from using Equitel by making it expensive. Last week, Equity revealed that Equitel’s transaction fees are capped at Ksh 27.50 with the receiving telco levying the extra fee.

https://twitter.com/KeEquityBank/status/634008378356862977

So with the case Ksh 135 transaction fees, Equity takes Ksh 27.50 with Safaricom taking the rest. Safaricom is doing this intentionally to fight Equitel and to be honest, I think it will work in Safaricom’s favor. No one will opt to pay all that much in terms of transaction fees.

We will keep you updated on this and if/when the transaction fees change.